To be or not to be?

This was interesting – the Financial Analyst Briefing Slides from last week’s Adobe Max conference. Yes, you read that right – the financial analyst briefings are interesting.

As a former accountant who is genuinely frustrated that the 2013 Q1 earnings report lacks detail, the financial analyst slides count as light reading! And the great thing about financial information, you’ve got to be more truthful in your communications with investors than in mere marketing hype (although such relative truthfulness didn’t help those triple A rated banks that vanished in a puff of smoke).

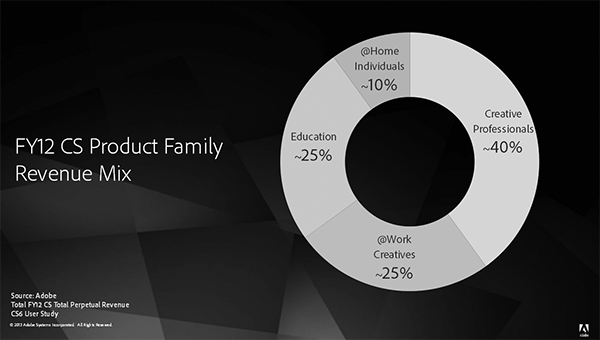

It’s most interesting from page 24 where there’s a breakdown of Adobe’s Creative Suite revenue (the whole suite, not just Photoshop) showing 10% comes from home individuals. That’s more than I expected, and 25% from education seems reasonable. I’m not sure about the difference between “Creative Professionals” and “@ Work Creatives” – maybe the former are indeed professional, and the latter more anarchic?

One reason for looking at this presentation was that Adobe have been talking about how the Creative Cloud has gained 500, 000 subscribers in the last year, and I was interested in seeing how big a proportion this might be. So the next slide – the installed base – helps put the number in perspective as it shows Adobe have around 8.4 million Creative Suite customers, half on CS6, and another 4 million on “point products”. Obviously there are no figures for the pirate base, which I only mention because it might indicate the potential for new honest customers.

Although one can’t assess the profitability of these 500,000 voluntary subscribers relative to existing customers, there is a price rise hidden in the subscriptions. Taken together with the 500,000 seeming a decent proportion of the user base, it might lead you to infer the switch to compulsory subscription is a sign of Adobe confidence.

On the other hand, the last slides show a forecast of reduced creative product sales for the next 3 years until they reach the promised land of 4 million subscribers in 2015, and that may make you wonder if the switch is as much a response to an existential threat. If they hadn’t gone for a compulsory subscription model, what might have happened?

You’d like to think it is confidence, wouldn’t you?

Other stats worth noting

From the Q1 FY13 investor datasheet

- Creative Suite/Cloud products account for just under 70% of Adobe’s revenues (sales), while the Marketing Cloud (web analytics, ad serving, business forms ) is 27%.

- 50% of revenues are in the Americas, 30% in Europe, Middle East, Africa, and 21% in Asia

- Subscription sales are about 25% of total revenue, although most of this will be Marketing Cloud products, not voluntary Creative Cloud subscriptions

- These are only sales and they don’t break down the real number – profitability