More numbers

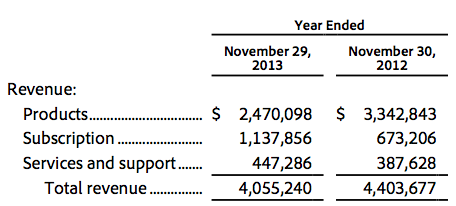

Comparing the first 11 months of FY2013 with the same period last year, you see the hit Adobe are taking as they sacrifice product sales for subscriptions.

Adobe announced their FY2013 Q4 results yesterday and the headline, I suppose, must be that they have met their target of 1.25 subscribers by the year end:

Adobe exited Q4with 1 million 439 thousand paid Creative Cloud subscriptions, an increase of 402 thousand when compared to the number of subscriptions as of the end of Q3 fiscal year 2013, and enterprise adoption of Creative Cloud was stronger than expected.

And who is surprised? After all, Adobe’s management certainly aren’t so stupid that they would have offered up for public scrutiny a target that they didn’t believe – almost know – they would be able to exceed. We have no real idea about their private targets, their best and worst cases, but the main point is that in terms of their credibility with their investors they have reached first base (isn’t that phrase British English nowadays?). In any case, it’s important to remember that Adobe are playing a longer game – 4 million subscribers by 2015 (p17) – and even if they hadn’t hit this year’s stated target, they still have momentum in that direction.

I think there are other reasons for not going overboard about the subscription numbers. Unless I have missed something, the target or actual subscription numbers don’t seem to be broken down into suite and single app. So are the numbers bloated by more single app subscriptions than they need for their overall revenue targets? Secondly, the repeated extensions of the first year discount on the Photoshop + Lightroom package would also eat away at the revenue that those subscription numbers represent. In each case, other than their high stock price (which reflects the wider economy as well as investors’ confidence in future revenue streams), we have little way of being certain if they have indeed done well or not.

While I endured 20 years in a suit, I’m not sure I would inflict upon you the rest of the Q4 and FY13 earnings call script and slides or other new documents on the investor relations page as I don’t see any more interesting detail, and I still can’t really decide whether Adobe are proceeding in this direction because of confidence and strength, or because they see no alternative for the future of the business. I do wonder what would Steve Jobs have said about Adobe’s increasing dependence on subscriptions?